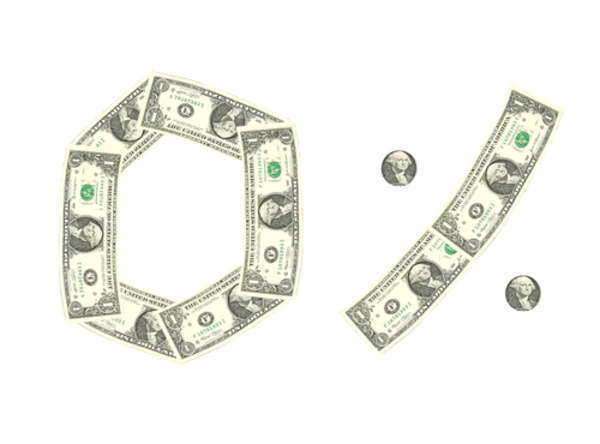

Getting 0 APR on Balance Transfers

What is a Credit Card Balance Transfer?

A credit card balance transfer offers an individual with credit card debt the ability to transfer or payoff the outstanding debt of one credit card by utilizing another credit card.

Balance transfers are typically made when an individual has accrued massive debt on a credit card that contains a higher APR. The high ARP, stricken the individual by placing increased fees on each monthly payment. When a credit card transfer is made, the individual pays off a portion of the balance by using a credit card with a lower APR.

The individual in theory, who exercises a balance transfer with a lower APR is saving money in the form lower interest payments.

What is a 0 APR Transfer?

The ARP is essentially the interest charged by a credit card issuer for the credit line offered to the individual. As a result of this definition, those companies who issue credit cards with a 0 ARP will not charge interest on the individual’s outstanding balance; the amount unpaid is simply that and not additional fees or interest is added onto the remaining balance.

That being said, all credit card companies aim to earn a profit, so it is atypical that a company will issue a credit card with a 0 ARP, especially to those individuals who are viewed as risk, in regards to defaulting on their payments. Although it is rare; however, many credit card companies will offer a limited 0 ARP for new issues of credit cards.

The limited timeframe is meant to entice consumers into purchasing new credit cards. Over time, the offer is lifted and the card is attached with a more common APR, which will typically float between 10 and 20%.

How to Obtain a 0 APR on Balance Transfers:

Similar to the issuance of a new credit card, lenders will evaluate certain statistics of prospective applicants. To obtain a 0 APR on balance transfers, the applicant possess a solid credit score.

Credit card companies will not offer such a maneuver to an individual who exhibits a low credit score or a sketchy credit history. Additionally, the credit card company will evaluate the applicant’s income, their occupation, and in some cases their education. Although somewhat difficult given the state of America’s credit market, the ability to obtain a 0 APR on balance transfers is possible.

The process is similar to receiving a new credit card; the individual is typically offered the ability to utilize a 0 APR on balance transfers and either approved or rejected following a subsequent review of their application.

Once approved, the individual may pay-off their remaining balance by using the new credit card with the 0 APR, or may directly transfer the remaining balance from the old credit card to the new credit card.

Additionally, the individual may write a balance transfer check against the accounts, which then may be deposited into the individual’s bank account.